Download PDF Fact Sheet on Medical Loss Ratio (MLR) Here

What is Medical Loss Ratio (MLR)?

A basic financial measurement used in the Affordable Care Act (ACA) to encourage health plans to provide value to enrollees. The ACA requires health insurers to submit data on the proportion of premium revenues spent on clinical services, also known as the Medical Loss Ratio (MLR). This measurement discourages insurers from spending a substantial portion of premium dollars on administrative costs, marketing, and profits.

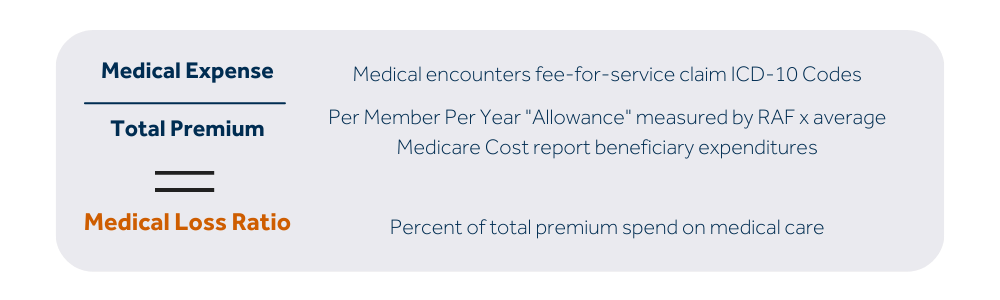

How is MLR calculated?

Medical Expense/Total Premium = Medical Loss Ratio (MLR)

What are MLR standards?

The Medical Loss Ratio provision of the ACA imposes an MLR requirement of 85% on Medicare

Advantage plans. That means 85% of their revenue must be used for patient care and quality

improvements, and their administrative costs can’t exceed 15% of their revenue.

If a Medicare Advantage plan fails to meet the MLR requirement, a rebate must be sent to the Centers

for Medicare and Medicaid Services (CMS). If it fails to meet the MLR requirement for 3 consecutive

years, CMS will not allow that plan to continue to enroll new members. And if a plan fails to meet the

requirement for 5 consecutive years, the Medicare Advantage contract will be terminated.